Credit Dispute Letter Templates – It’s A Bad Idea

There are many websites out there offering your Free Credit Repair Dispute Letter Templates. Websites that take your information, or give you (nearly) useless form letters that can do more harm than good. Websites like MyFico.com are giving Free Dispute Templates. But why are the Credit Bureaus making it easy for you to dispute items? Why are they helping you to remove negative items? Why do they ask you to do credit disputes online and not work with a credit repair company?… Because it saves them Money, Time, Effort, and Legal Fees. When you dispute online, you’re giving up your legal rights under the FCRA. So, Don’t Dispute Negative Items Online. Make it hard for the banks and the credit bureaus, don’t allow them to have the easy way out. The Fair Credit Reporting Act was made for consumers to fight back against Banks, Creditors and Credit Bureaus.

Cons Of Credit Bureau Dispute Letter Templates

There are pro’s and con’s to everything, so let’s list out the cons here…

Dispute Letter Templates Are Overlooked

When you send a dispute letter to the credit bureaus in the mail, it goes to a processing center. The mail is opened by a machine that reads and interprets your dispute letter. This machine is a high tech computer doing a process called OCR – Optical Character Recognition. It will overlook dispute letters that are form letters. It knows what letters to throw out and which ones to keep and place an importance on.

Credit Bureaus Don’t Give Your Disputes The Proper Attention

Credit Repair Dispute Letter Templates, since they are typically overlooked by the credit bureaus, are not given the proper attention. If your form letter is customized enough to make it past the Credit Bureau’s Computer System, it will still probably never be touched by a human. The Bureaus take your dispute letter and make a 3 digit code for your dispute reason. Why is this important? When you write a paragraph about why you are disputing an account, you can’t sum that up into 3 digits… Right?

Credit Bureaus May Place Fraud Alert On Your File

When Credit Bureaus receive a form letter from you, they will often respond with a letter saying “We Don’t Honor Your Suspicious Request,” or “We have been notified of fraud on your credit profile.” They may ask for better identification documents when you gave them everything, and even worse…

Credit Bureaus May Block Future Disputes

Credit Bureaus have been known to block your future disputes if you send a “suspicious request.” This means that it will make is a lot harder for you to fulfill future disputes with them. This can cause a lot of stress, lost time and frustration.

How To Create Dispute Letters

We are going to show you the options you have when it comes to how you are going to create the dispute letters.

Work With A Credit Repair Professional

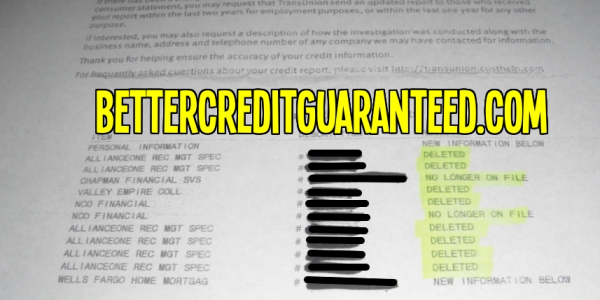

Since we are a group of passionate credit repair professionals, I’d highly recommend scheduling a free credit audit and consultation with one of our Advisers. You can call us toll free at 1-800-216-2725 or visit our website BetterCreditGuaranteed.com Credit Repair Companies have a bad name, so always check to make sure your company has good reviews. Lexing…. Oh, I can’t say their name on here. Just don’t work with a “Law Firm” that rhymes with Hexington.

Create Handwritten Letters

Handwrite Your Dispute Letters To the Credit Bureaus. Hand write your envelopes too. Make sure that you are specific about why you are disputing your accounts and NEVER say “This account isn’t mine” unless it’s the truth.

We’d be happy to schedule a consultation with you to answer all your questions!

BetterCreditGuaranteed.com or 1-800-216-2725