LATEST POST

3 Steps to Build Your Credit Score Fast

If you are trying to build your credit fast, but are at a standstill on how to do so, we’ve got some options for you. Whether you are looking into obtaining a home loan, auto loan, personal loan, or just join 700+ club, following through with these steps can help guide you where you need…

Section 609 Credit Repair Dispute Letters – Scam!

Have you been searching the internet, looking for a Credit Repair Dispute Letter to help you restore your credit? You’ve probably seen a bunch of hype about Section 609 Credit Repair Dispute Letters. In this article, I’ll explain more about Section 609 Dispute Letters, even give you a free template. Just please, don’t use it.…

3 Steps to Build Credit Fast!

If you’re looking to build or rebuild your credit fast, these are the 3 simple steps you’ll need to follow to ensure that your credit scores are headed in the right direction. Building Credit isn’t a complicated process if you know what you’re doing and you have the right mentor to guide you through the…

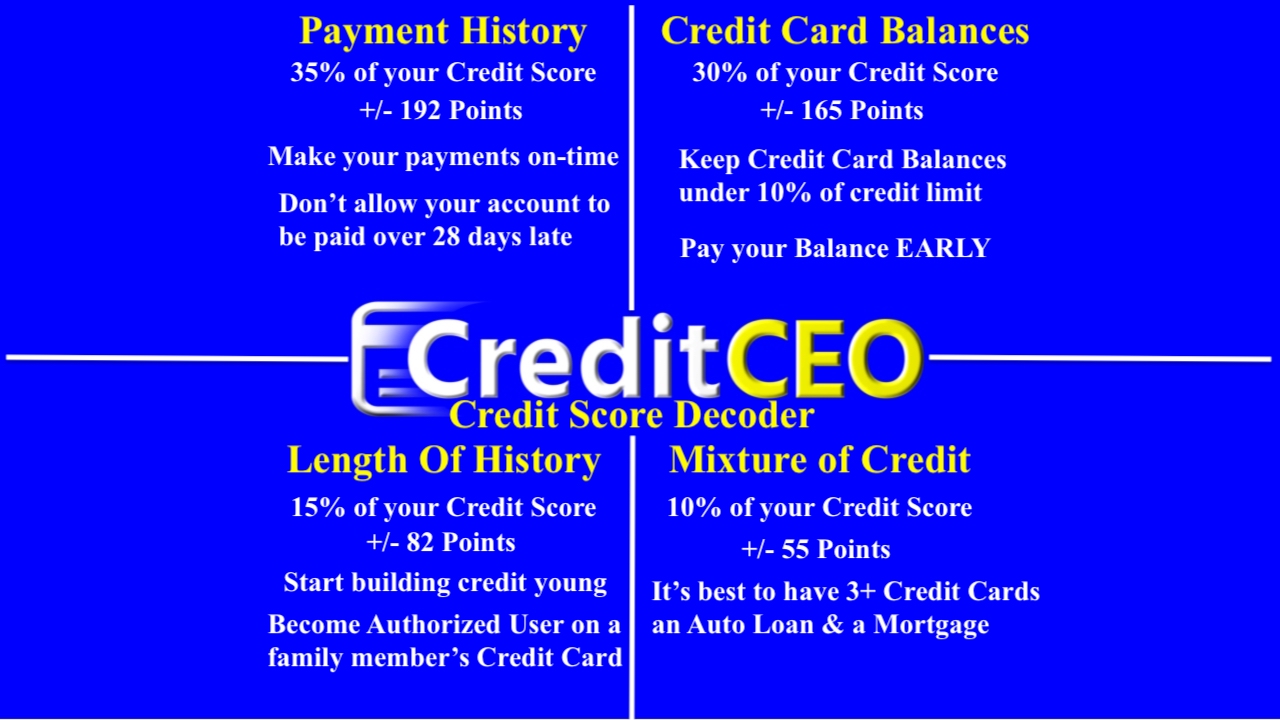

The Credit Score Decoder

Welcome to 2019, I hope you had an incredible New Year. We’ve been thinking about what we can deliver to our current and former students that would allow you to meet or exceed your credit goals in 2019. Here is my gift to you. I’m calling it the Credit Score Decoder. It’ll help you understand…

Finally A High Interest Checking/Savings Account w/ Robinhood

Finally, a Checking & Savings account that pays you 3% interest!?!? It’s finally here! I’ve been waiting for this for over 15+ years! Robinhood, my favorite app for investing in stocks, is rolling out a Checking & Savings account that pays you 3% interest, with NO FEES!! http://share.robinhood.com/jesser53 Robinhood also allows you to invest in…

Using Free Tools & Your Credit To Save EXTRA Money Online!

**There is nothing being sold in this post – I’m strictly trying to save you money** What is the best way to save money on Black Friday, Cyber Monday and Beyond? There is a way to save money, above and beyond the sales you see advertised online. Here is an example of how I saved…

How to Buy a Car at the Lowest Rate and Price

Top Secret Tips to Buy a Car Whether you’re in the market looking for a first, replacement, or even a second vehicle for your family, dealing with the ins and outs of purchasing a new car can be exhausting and down right frustrating at times! Buying a car, especially a model from the last 12…

Dispute Letter Templates Are Bad For Credit Repair

Credit Dispute Letter Templates – It’s A Bad Idea There are numerous websites out there offering your Free Credit Repair Dispute Letter Templates. Websites that take your information, or give you (nearly) useless form letters that can do more harm than good. Websites like MyFico.com are giving Free Dispute Templates. But why are the Credit Bureaus making…

How Long Negative Information Reports

As you probably already know, your credit report is a valuable asset to your financial future and freedom. It contains such information which holds you responsible for your spending habits and likelihood of paying bills on time. Not only does your credit report play a major part on being approved for basic necessities such…

Why you shouldn’t sign up for Equifax’s free credit monitoring

Chances are you probably heard about the big Equifax breach. According to the Federal Trade Commission, from May to July 2017, 143 million people were affected in which personal and sensitive information was exposed including birthdates, tax information, social security numbers and addresses of those who have a credit report. Not only was sensitive…