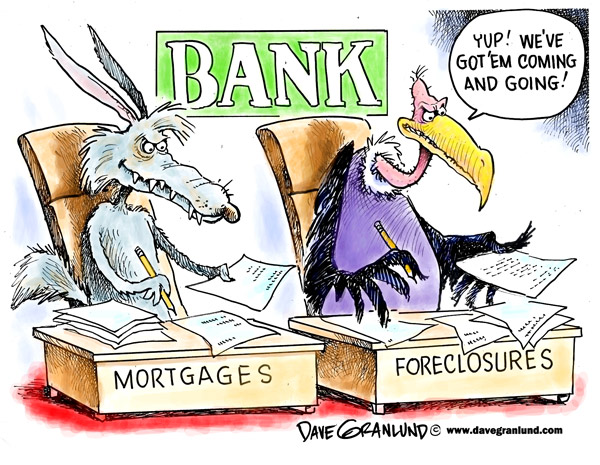

Foreclosure… a word that has become more familiar to the general public,

home owners and potential home buyers. Whether you are considering foreclosure

as an option for your home, or enjoying the discounted prices that come with purchasing

a previously foreclosed home, just like any major decision keep in mind some key factors before making your final decision, because it just may determine your financial standing for the next 7 years…

When a financial crisis strikes your path and you are months to years behind on your mortgage, foreclosure may seem like the best option. It is however best to be educated on how this decision will affect your credit report for multiple years.

1.) Foreclosure will DESTROY your credit. For each month up to 2 years the lender will report your payments as LATE until moving it into a collection status. This will drastically lower your credit score by hundreds of points.

2.) Foreclosures will stay on your credit report for a total of 7 years, and you will be required to wait 3 years after the foreclosure to purchase a home again! Unless we of course are able to get the foreclosure deleted from your report, then you can purchase much sooner.

3.) If that doesn’t sound like enough, you will ALSO be held responsible with a deficiency balance; the difference between what the lender eventually sells the home for and what you ACTUALLY owe after the auction. The bank can then pursue through legal action in court and even (rarely) garnish your hard earned wages!

If you are looking for an alternative path rather then foreclosure, consider a short sale

FIRST. Not only will this relieve you from the deficiency balance, but it will not have nearly the adverse impact to your credit profiles.

Purchasing a home that fell into foreclosure could save you thousands!

Lenders price their foreclosures based on current appraisal snapshots of the current real estate market. In short, the sales price most often reflects the low end of the homes of equal size and age are selling for in the current market. We wouldn’t suggest doing this alone, you will need to deal with the lender in the transaction instead of an individual seller. The realtor involved in the purchase will assist you with negotiating, as they have experience with foreclosure lenders.

If you’ve found yourself facing foreclosure feel free to reach out to us at http://BetterCreditGuaranteed.com

or 1-800-216-2725