Purchasing Short Sale Homes

Purchasing Your Dream Home for Half the Cost Dramatic drops in property values over the last few years have left many home owners owing more money on their homes than what it is actually worth. This has created an opportunity for lenders and buyers in the market to take advantage of discounted homes from short sale properties, creating a price…

Big Benefits from a Short Sale

The Light at the End of the Tunnel Did you know that everyday another American family is facing the harsh reality of a foreclosure zeroing out their chances for being able to own another home someday? Did you also know that a foreclosure can allow your lender to keep pursuing on the remaining balance of…

Vantage VS FICO

Vantage VS FICO Did you know that there are different score models other than just FICO? Vantage Score is the first credit scoring model that was created by the credit bureaus which created a radical change in the score range. With a system so out of the norm, industries never accepted the model, and continued with FICO 08 or…

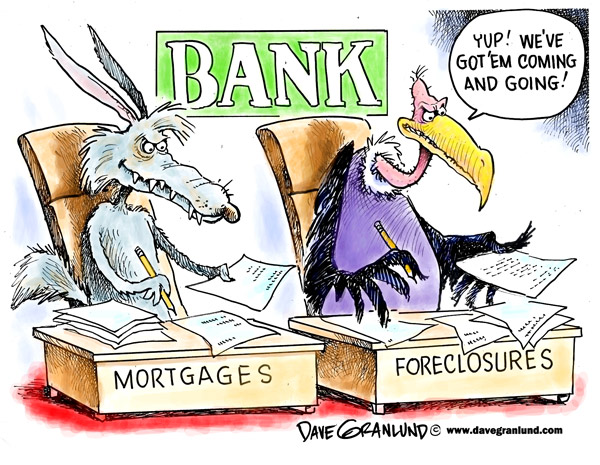

Foreclosure…An all to Familiar Word

Foreclosure… a word that has become more familiar to the general public, home owners and potential home buyers. Whether you are considering foreclosure as an option for your home, or enjoying the discounted prices that come with purchasing a previously foreclosed home, just like any major decision keep in mind some key factors before making…

FICO and You

The Origins of Your FICO Score Well, lets travel back to the 1960’s with a company by the name of Fair Isaac whom devised a very unique and intricate mathematical computation formula to determine the credibility of consumers who apply for loans. This formula allowed the company to study a person’s personal credit history and generate a 3 digit number…

Secret Solution for Late Payments

Strapped for Cash and Can’t Make a Payment? The truth is, anyone who is human has made a late payment(s), and sometimes you just know that at some point you are going to have to pick and choose which payment will have to wait until next month, whether it’s for a cell phone, credit card,…

Credit Repair Can Be Intimidating…

Credit Repair is Scary It’s no secret that credit repair can be intimidating, and often a big commitment to undertake. The truth behind the curtain only unfolds a long passage to hard work, and lies created by creditors creating smear campaigns to convince consumers that there is nothing that can be done to fix…

Why You NEED Credit

Why You NEED Credit, Even if You Don’t Want it A common misconception from consumers often suggests the notion of spending cash will prevent any sort of credit account reporting and damaging a credit score what-so-ever. While this generalization is only partly true, a consumer must recognize that if they were to only proceed with cash purchases,…

What is the Secret to Good Credit

What is the Secret to Good Credit? Well, it’s just another catch 22 that the banks and bureaus fail to clarify and educate to their consumers. The average client assumes that if they are paying their bills on time this will justify and maintain a reasonable credit score; this assumption though is in fact false.…