Credit Disputes – Sending One Dispute Never Works

All too often, I’m asked, “why do you have to do credit disputes every month, can’t you just do one dispute that will delete everything?” I should start off by letting you know that I am the Sr. Credit Advisor at Cobalt Credit Services in Seattle, WA. We are a Credit Repair and Credit Restoration…

How to Remove a Public Record

Tax Liens, Judgments, and Bankruptcy… OH MY! Are you finding your self overwhelmed and embarrassed with tax liens, judgments, and even bankruptcy? In all actuality, these public records are harder to remove from your credit report then you’d think. There is absolutely no 100% guarantee that ANY credit repair company can assure the removal of…

The Truth About Student Loans…

Do you have past derogatory student loans, weighing your credit down with low scores? Unfortunately there’s no quick easy solution to remedy this situation, and they can be some of the hardest accounts to remove. If your loan was through federal student loans, derogatory information can even report indefinitely! This means the accounts do…

Establishing Good Credit

Establishing Good Credit Establishing credit can be one of the best ways to start your financial future. If you never had to use credit before, congratulations! Paying cash for your necessities can be much less stressful when it comes to credit card payments, loan payments, and even interest rates. But if you are young,…

Credit Rights

Just Sign On The Dotted Line.. Have you ever read the entire terms and agreement contract prior to signing your rights over to the credit card companies? If your answer is no, your just like millions of other American’s who don’t have the time to read the lengthy contract word for word…but how this affects you…

Purchasing Short Sale Homes

Purchasing Your Dream Home for Half the Cost Dramatic drops in property values over the last few years have left many home owners owing more money on their homes than what it is actually worth. This has created an opportunity for lenders and buyers in the market to take advantage of discounted homes from short sale properties, creating a price…

Big Benefits from a Short Sale

The Light at the End of the Tunnel Did you know that everyday another American family is facing the harsh reality of a foreclosure zeroing out their chances for being able to own another home someday? Did you also know that a foreclosure can allow your lender to keep pursuing on the remaining balance of…

Vantage VS FICO

Vantage VS FICO Did you know that there are different score models other than just FICO? Vantage Score is the first credit scoring model that was created by the credit bureaus which created a radical change in the score range. With a system so out of the norm, industries never accepted the model, and continued with FICO 08 or…

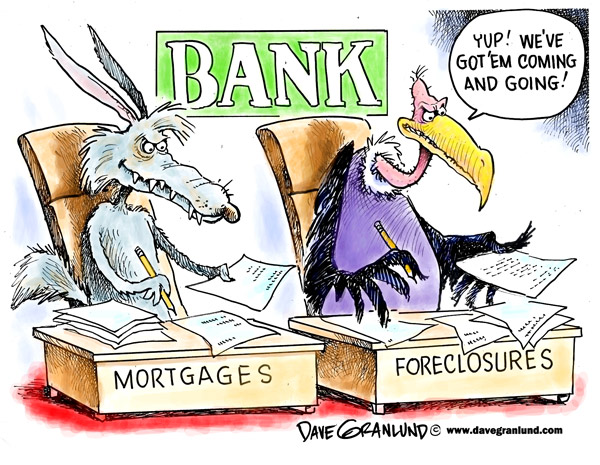

Foreclosure…An all to Familiar Word

Foreclosure… a word that has become more familiar to the general public, home owners and potential home buyers. Whether you are considering foreclosure as an option for your home, or enjoying the discounted prices that come with purchasing a previously foreclosed home, just like any major decision keep in mind some key factors before making…

FICO and You

The Origins of Your FICO Score Well, lets travel back to the 1960’s with a company by the name of Fair Isaac whom devised a very unique and intricate mathematical computation formula to determine the credibility of consumers who apply for loans. This formula allowed the company to study a person’s personal credit history and generate a 3 digit number…